r&d tax credit calculation software

RD Tax Credit Calculator. Maximize credit with defensible claims.

Tips For Software Companies To Claim R D Tax Credits

The RDEC is paid as a taxable credit of your RD costs.

. GOATtax is an RD tax credit platform that was created by Source Advisors to assist taxpayers in claiming the RD tax credit. Because it is taxable the cash benefit youll receive is 11 after tax. A 15 minute risk free no.

It should not be used as a basis for calculations submitted in your tax. From biotech to breweries were on a mission to democratize the RD tax credit. The results from our RD Tax Credit Calculator are only.

Call us at 208 252-5444. Fiona performs the local RD tax credit calculation utilizing the qualification of projects and activities along with details of the associated expenses. A one hour risk free no obligation education call where we explain the RD tax credit in detail.

The Tax Credit Calculator is indicative only and for information purposes. You can then offset the. 130000 from your trading profit for the year to work out your revised taxable.

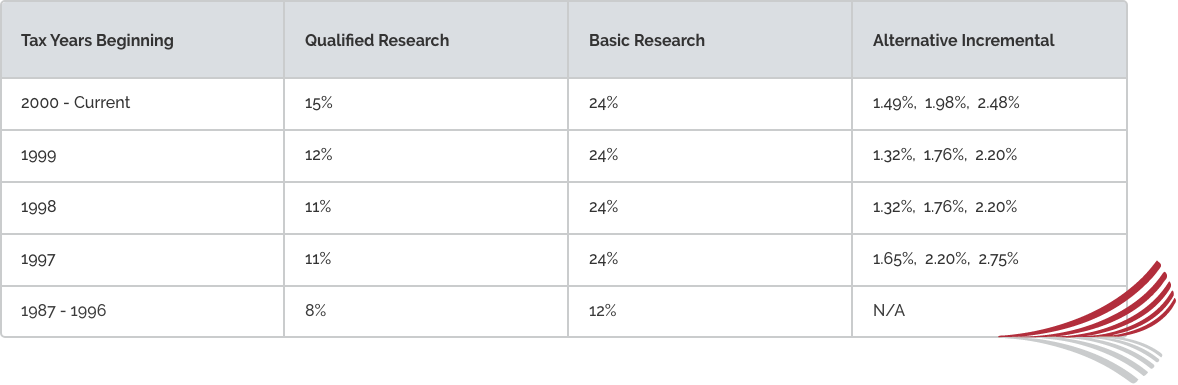

At Strike we work on a success-based fee structure enabling businesses in the. The current rate for the RDEC is 13. The ASC approach enacted in 2006 makes this calculation a bit easier with respect to the base amount rather than utilizing information from 1984-1988 a taxpayer can now elect on an.

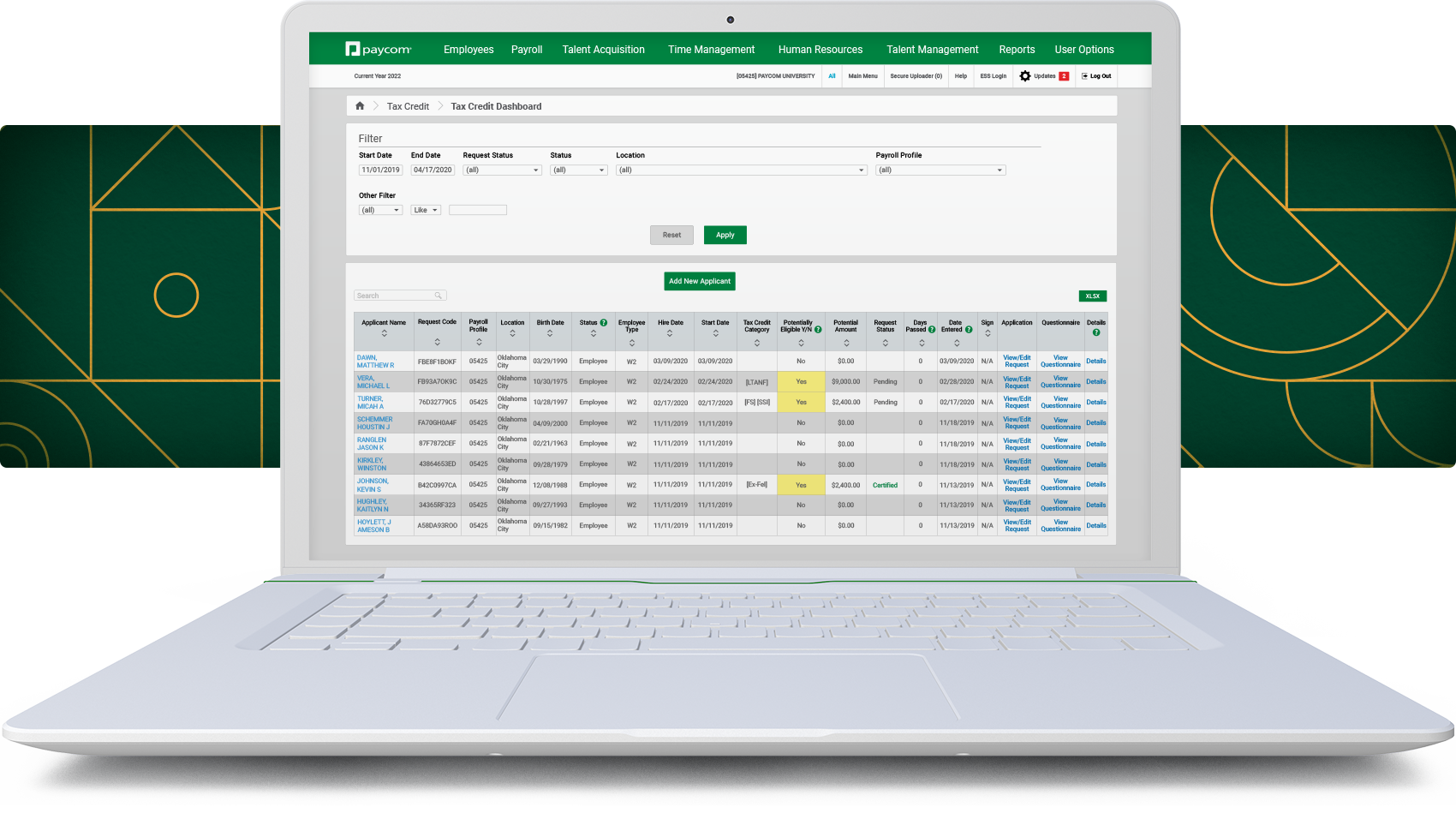

You can now complete your tax. Plus every study is reviewed by RD tax credit experts. Driven by IRS audit guidelines our software calculates your credit in real time.

RD tax credit calculation for profit making SMEs. Strike Tax Advisory employs tax experts and technologists with years of experience in RD Tax Credits. Source Advisors is a consulting group that was formed over 30.

In general profitable SMEs can benefit from average savings of 25 so if a company. This call is required in order for us to determine whether you qualify. How are RD tax credits calculated.

Work out your taxable profit. Subtract your enhanced qualifying expenditure figure eg. Estimate your Federal and State RD Tax Credit with our FREE Tax Credit Calculator.

Our software takes a comprehensive RD tax credit process developed by subject matter experts and reduces it to three simple steps. Were here to make sure every qualified company gets the most out of their. Clarus RD for your business.

Startup Opportunity To Offset Payroll Taxes

Tips From The Art Of War To Help In Your Research Credit Battle Tax Executive

Check List For Identifying Potential Qualifying Tax Specialty Services

![]()

Timesheet Software For R D Tax Credits Replicon

.png)

R D Tax Credits Explained In 2022 What Are R D Tax Credits Who Is Eligible

R D Tax Credits A Guide To Eligibility Claim Preparation And Calculation

Simple Effective Powerful Research Tax Credit Software Tracker Suite

R D Tax Credits Explained What Are They Who Is Eligible

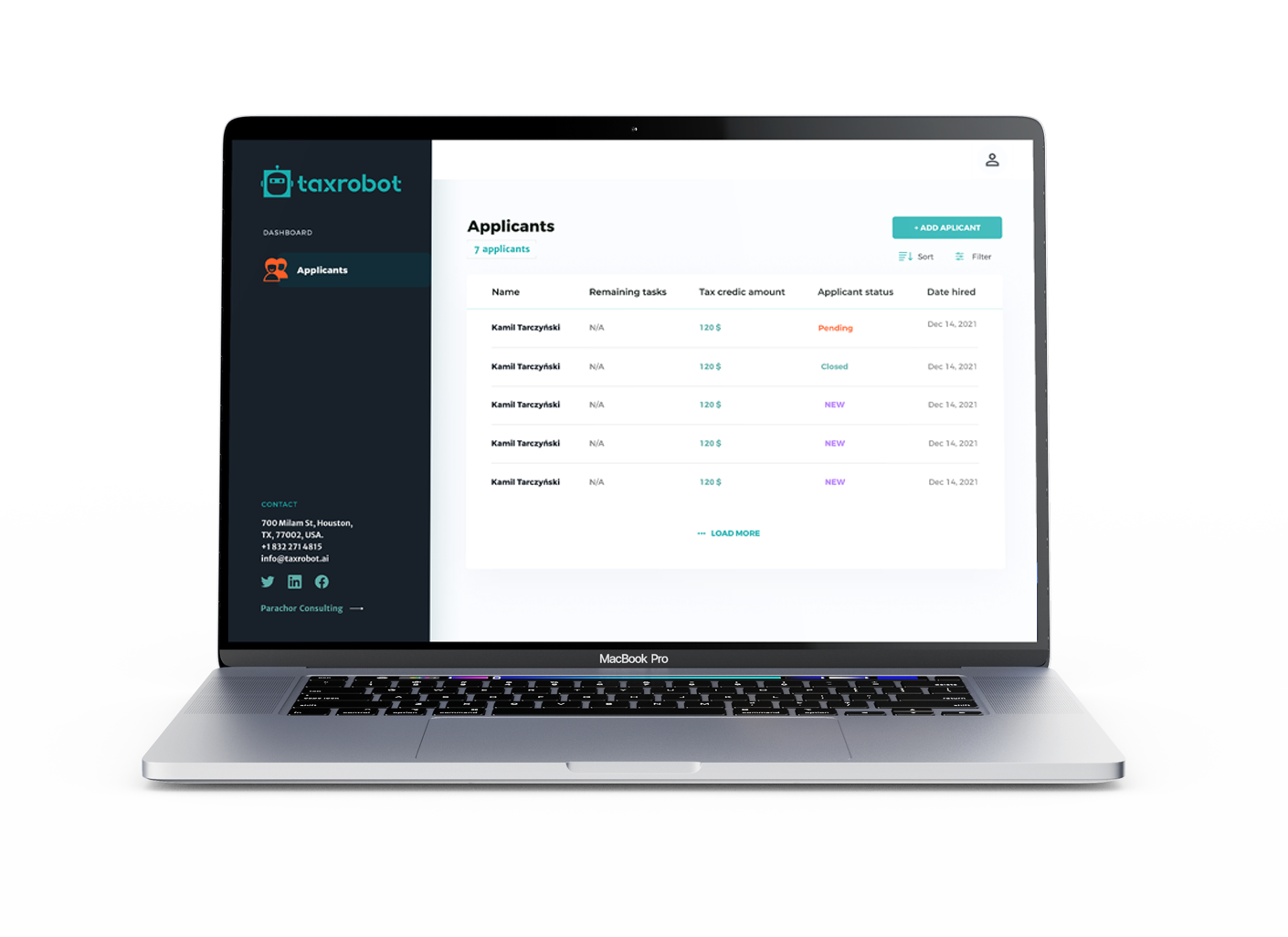

Havenocode Io Taxrobot No Code App Case Study

What Is The R D Tax Credit Who Qualifies Estimate The Credit

Software Startups Shouldn T Gamble When Claiming The Irs R D Tax Credit Built In

R D Tax Credit How Your Work Qualifies Alliantgroup

California R D Tax Credit Summary Pmba

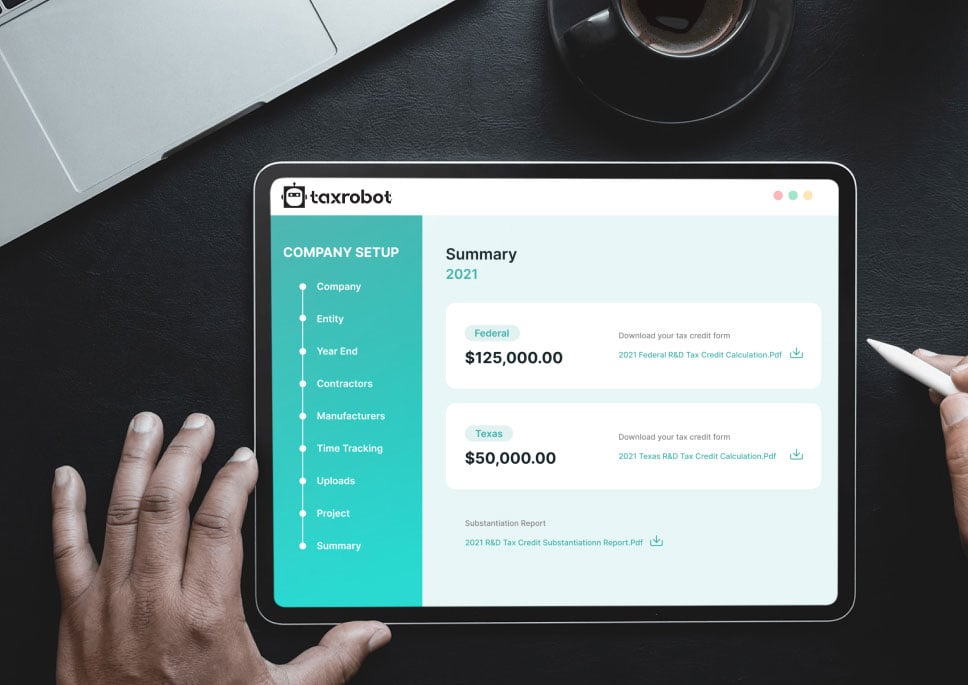

Taxrobot Ai Powered R D Tax Software Calculate Your R D Tax Credits

How The R D Tax Credit Rewards Job Shops And Contract Manufacturers